Gosport MP, Dame Caroline Dinenage, has welcomed the Spring Budget 2022 which will help support constituents across Gosport, Lee-on-the-Solent, Stubbington and Hill Head against the backdrop of rising prices.

The Chancellor of the Exchequer, Rt Hon Rishi Sunak MP addressed Members of Parliament this afternoon, setting out the economic plans for next year and outlining the building blocks for a stronger, more secure economy for the United Kingdom, including supporting people with the rising cost of living – in addition to the on the £21 billion of support already in place.

Prices have risen by 6.2% in the 12 months to February – faster than wages and the fastest rise for 30 years and this is expected to rise further by OBR averaging 7.5%.

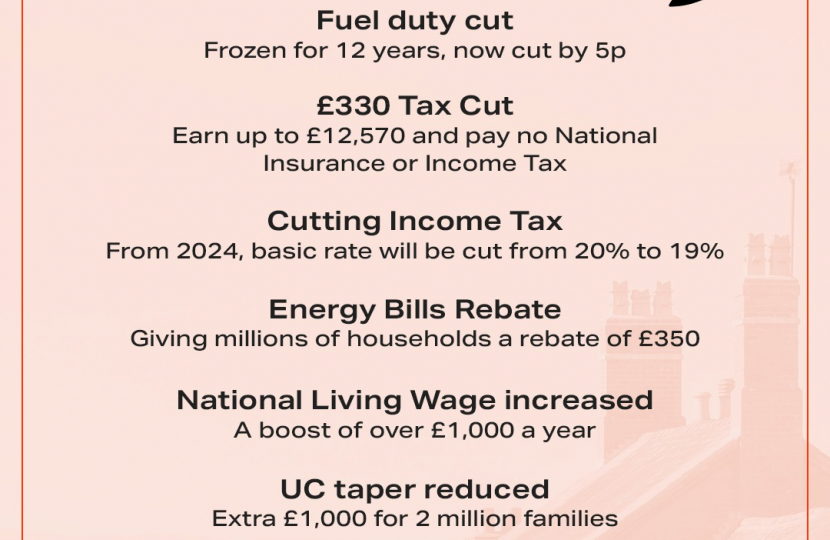

To help with the rising cost of living the Chancellor announced measures including -

- Fuel Duty will be cut by 5% - this is the biggest cut to fuel duty rates ever and worth over £5 billion. This will take effect from 6pm tonight (23rd March 2022) and will be in place until March 2023.

- VAT Relief - homeowners having materials like heat pumps, solar panels or insulation installed with pay 0% VAT as opposed to the standard 5%, this will save families up to £8,000 on installation and up to £300 per year on their energy bills. Wind and Water turbines will also be zero rated – reversing the EU’s decision.

- Doubling the Household Support Fund to £1bn, distributed via Local Authorities, supporting the country’s most vulnerable households.

- £330 tax cut – from July people will be able to earn £12,570 a year without paying any Income Tax or National Insurance.

- Employment Allowance will increase to £5,000, a tax cut worth up to £1,000 for half a million small businesses.

Commenting Caroline said:

“The last few months have been extremely tough for many of the Gosport Constituency’s residents and I am glad that the Chancellor’s Budget aims to provide further assistance and support to households with the rising cost of living.

Many of my constituents have contacted me with concerns about the rising cost of fuel amidst other price rises and so I welcome the decision to cut fuel duty by 5%, and the National Insurance reduction, which will more than cover the new NI Levy for the 70% least well-off. This will make a profound difference to many households.”

Delivering the Spring Statement, Chancellor Rishi Sunak said:

“This statement puts billions back into the pockets of people across the UK and delivers the biggest net cut to personal taxes in over a quarter of a century.

Like our actions against Russia, I have been able to do this because of our strong economy and the difficult but responsible decisions I have had to make to rebuild our finances following the pandemic.

Cutting taxes means people have immediate help with the rising cost of living, businesses have better conditions to invest and grow tomorrow, and people keep more of what they earn for years to come.”

This support is in addition to assistance with the cost of living that was announced earlier this year. This includes:

- A £200 ‘smoothing’ rebate on energy bills for all households

- A non-repayable £150 cash rebate for homes in Council Tax bands A-D – equivalent to 80 per cent of all households, helping both lower and middle income families.

- £144 million of discretionary funding for local authorities to support households not eligible for the council tax rebate.

ENDS

For more information contact [email protected] .

Notes to Editors

- Caroline is arranging a public event where local people can get information and assistance regarding energy bills and the cost of living on Saturday 26 March. You find out more at Cost of Living Event | Facebook.

- Caroline’s website provides advice and support for constituents on cost of living.